- Excel Add Ins Ribbon

- Office Excel Add Ins Monte Carlo Online

- Excel Add-ins Analysis Toolpak

- Excel Add Ins Graph

- Office Excel Add Ins Monte Carlo Excel

- Office Excel Add Ins Monte Carlo

RiskAMP is a full-featured Monte Carlo Simulation Engine for Microsoft Excel®. With the RiskAMP Add-in, you can add Risk Analysis to your spreadsheet models quickly, easily, and for a fraction of the price of competing packages. The PERT distribution for cost and project modeling. An easy-to-use wizard for creating tables and charts. Mac Excel Add Ins. For introductory information about Office Add-ins, check out the Office Add-ins platform overview article. This article describes various ways that Office Add-ins can extend and interact with Office clients like Word, Excel, etc. This add-in, MCSim.xla, enables Monte Carlo simulation from any Excel sheet.

With the RiskAMP Add-in, you can add Risk Analysis to your spreadsheet models quickly, easily, and for a fraction of the price of competing packages.

- The PERT distribution for cost and project modeling

- An easy-to-use wizard for creating tables and charts

- More than 40 random distributions, including correlated multivariate distributions

- 20 statistical analysis functions

- Latin Hypercube sampling

- Comprehensive VBA integration

- Automatic, embeddable histogram and correlation charts

- Distribution fitting

- Full support for 32-bit and 64-bit Excel 2010, 2013, 2016 and 2019

Try our new browser-based risk platform, RiskAMP web

conditional risk model from our sample spreadsheets

When you build a model of something in the real world — a stock portfolio, a project plan, a clinical trial — you have to build in assumptions about the future. You pick some values for your expected stock returns, for example, and project them into the future.

But the real world doesn't work that way. Stocks go up, and they go down. Projects run over time or under budget.

Excel Add Ins Ribbon

Monte Carlo simulation is a way to build this variability into your models. Instead of saying this stock will return X% every year, you can say things like this stock will return between X% and Y%; and then figure out what that means to your portfolio.

Once you have that variability in your model, you can start to understand the risk in your model.

What is the likelihood that you will lose money?

What is the probability that the project will run more than a year late?

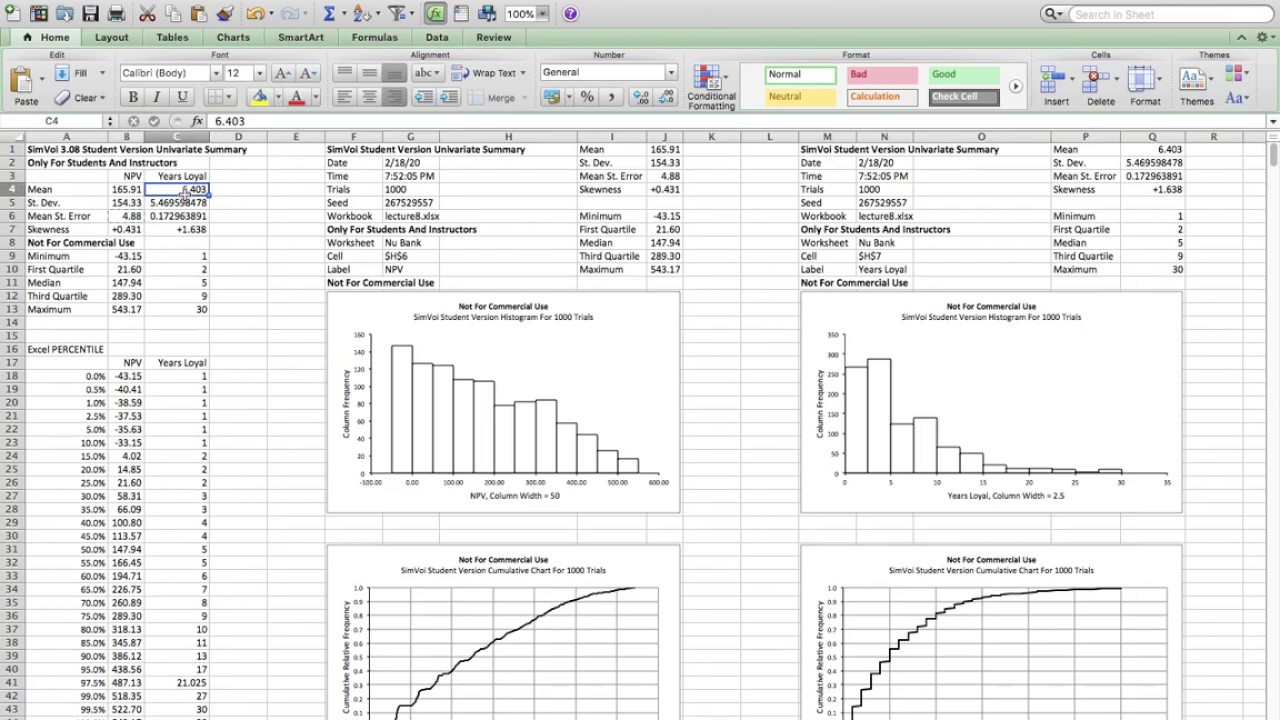

There are three key parts to a Monte Carlo simulation. First, as described above, we replace fixed values — things like expected stock prices and project costs — with random variables. We are adding random variability to the model.

Once that's done, we do the second step: we recalculate the model hundreds or thousands of times, each time changing the random values. This is the 'simulation' part — we are simulating the real world where values change randomly.

Finally, the third part: we analyze the results of the model by looking at the hundreds or thousands of results, and deriving statistics from those results. For example, we might run a stock portfolio through the simulation process. Then we can look at the results and say in 25% of the cases, the portfolio lost money. Or in 75% of the cases, the portfolio outperformed the market.

Office Excel Add Ins Monte Carlo Online

sensitivity analysis using built-in regression functions

We believe the RiskAMP Monte Carlo Add-In for Excel offers the best combination of features and low price — the best value in Monte Carlo simulation software. But don't take our word for it — we offer a free trial version of the software, as well as an unconditional 30-day money back guarantee.

The RiskAMP Add-in makes it easy to get started, with a complete point-and-click user interface for creating random distributions and generating charts and graphs. Once you get more comfortable with it, you can use the full set of Excel functions to design more complex and more insightful analytical models.

And we are always happy to help you design and implement your spreadsheets to get the most our of your analysis.

Excel Add-ins Analysis Toolpak

Read more:

ModelRisk is a Monte Carlo simulation FREE Excel add-in that allows the user to include uncertainty in their spreadsheet models. ModelRisk has been the innovation leader in the marketplace since 2009, being the first to introduce many technical Monte Carlo method features that make risk models easier to build, easier to audit and test, and more precisely match the problems you face.

This great free tool was flagged to us by our friend and contributor Alex Sidorenko, founder of the well known Risk Academy. Below you can find the main features of this free tool, the download links, including free example models that you can use to quickly start working on your models. We have also included Alex Sidorenko’s personal review of this software, providing his insights and opinion, which adds value to the community, considering Alex’s extensive experience using multiple Risk Management solutions.

Why Use ModelRisk to do Risk Analysis?

Vose Software, the company behind ModelRisk, and other integrated suites of state-of-the-art risk analysis and management tools, addresses three main questions every decision-maker needs to know:

- How sure are we about the predictions made with our Excel model?

- How vulnerable are the predictions for unplanned events?

- What effective ways are there to control the risk?

Vose Software offers ModelRisk as a free risk analysis add-in for Excel that can provide the tools to answer these questions.

What Is ModelRisk?

ModelRisk is a Monte Carlo simulation Excel add-in that allows the user to include uncertainty in their spreadsheet models. ModelRisk has been the innovation leader in the marketplace since 2009, being the first to introduce many technical Monte Carlo method features that make risk models easier to build, easier to audit and test, and more precisely match the problems you face.

A ModelRisk user replaces uncertain values within their Excel model with special ModelRisk quantitative probability distribution functions that describe the uncertainty about those values. ModelRisk then uses Monte Carlo simulation to automatically generate thousands of possible scenarios.

Excel Add Ins Graph

Typical Questions That Can Be Answered with ModelRisk

Office Excel Add Ins Monte Carlo Excel

At the end of the Monte Carlo simulation run, which typically takes a few seconds, the results are displayed in a variety of graphical and statistical formats that will tell you things like:

- How likely is it we will come under budget?

- Which investment gives me the greatest return for a given level of risk?

- How exposed are we to changes in energy price?

- How much capital do we need to be 95% sure of having enough for the project?

- How much do we need to hold in reserve to be 90% sure of covering the risks in our business?

- What is driving the success of our venture and how do we manage that?

Risk Academy’s Alex Sidorenko Review

Screenshots

Downloads

Office Excel Add Ins Monte Carlo

Download Brochure

Watch Webinar

Download ModelRisk Basic FREE

Download ModelRisk Models